Our Story

Our Customer Segment:

Whole idea of starting Nidhi lakshmi Finance NBFC germinated while Deepak was shopping at a local artisan shop in Rajasthan and found how lack of credit is stifling the entrepreneurship spirit in our great country.

Even after 25 years of Economic reforms in India, MSE sector, hero of the emerging India still remains unserved by banking channels. A recent study shows Rs 45 Trillion would be the total credit demand of the MSE sector of which only 11.37 trillion is met through formal sources. Remaining Rs 33.6 trillion (75% of total demand) is either met through informal sources including high interest charging local money lenders or remains unmet. Surprisingly, MSME sector contribute nearly 45 percent of the manufacturing output and 40 percent of the exports. This sector employs over 100 million people, providing the largest share of employment after agriculture in a country populating more than 1 billion.

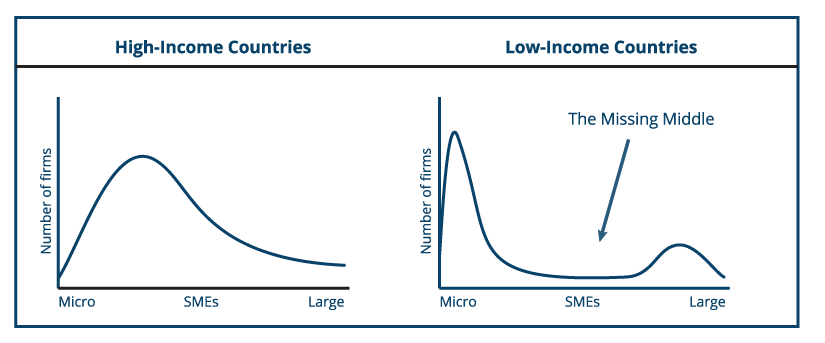

Source: Entrepreneurial Finance Lab Research Initiative, Center for International Development at Harvard University

As India progresses towards being a developed country, it is imperative we will need more SMEs and micro enterprises. It is this missing middle which largely remains unserved as its credit demand is too small for banks and too large for MFIs. Our team has worked very closely with MSEs and understands their unique product requirements, which is not available in traditional banking. We strongly believe this sector is the hidden gem which will propel India’s progress and prosperity in the coming years. We provide loan to both urban poor & rural poor to meet their productive requirements in starting new business or for growing an existing business. Timely availability of funds will empower enterprises, enrich lives, transform communities, and breed prosperity, resulting in more entrepreneurs, which we are here to serve. Our policy is “लोन ही नहीं, साथ भी देते हैं हम”, meaning our hand is not just for funding you, but to handhold and lift you up higher.

Being a customer centric organization, our team spends a lot of time on the ground with these entrepreneurs, understand their requirements and tailor make the unique products. We do regular market research and product pilots to gain customer insights to improve processes, products and venture into the potential credit market.